draftkings 1099|How do I opt in to electronic : Manila The best place to play daily fantasy sports for cash prizes. Make your first deposit! Tanulmányozza és próbálja ki a kaszinó játékok bármelyikét korlátok nélkül, ezek után kiválaszthat a bónusz oldalunkról egy elismert kaszinót, amely valódi pénzes játékokat szolgál (akár egy ingyenes bónuszt is igényelhet). Tekintse át .

draftkings 1099,If you qualify to receive tax forms from DraftKings (IRS Forms 1099/W-2G), you can access the information directly from the Financial Center. You can expect to .

If you have greater than $600 of net earnings during a calendar year, you .Forms 1099-MISC and Forms W-2G are expected to be available online at the .How do I opt in to electronicTax FAQs. Why am I being asked to fill out an IRS Form W-9 for DraftKings? (US) .The best place to play daily fantasy sports for cash prizes. Make your first deposit!draftkings 1099 How do I opt in to electronicIf you have greater than $600 of net earnings during a calendar year, you can expect to receive an IRS Form 1099-Misc from DraftKings. This form will include all net earnings . If you need help locating your DraftKings Tax Form 1099, we have a handy guide to show you where it is and why and how to fill yours in.

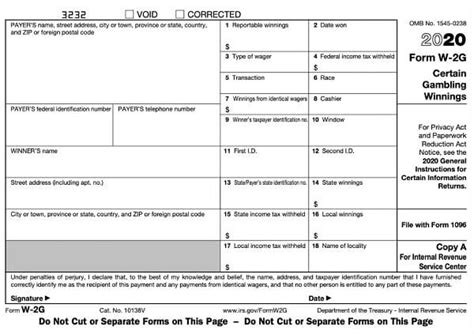

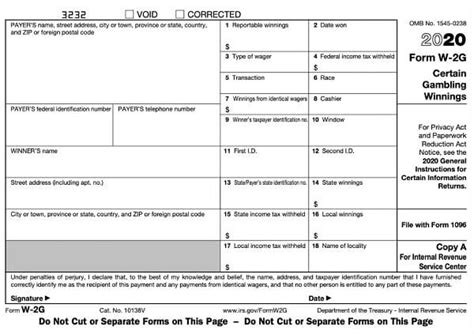

If you don’t want to receive a physical tax form in the mail, you can opt to receive electronic-only tax forms instead. Note: Fantasy app customers can change their IRS Form W-9 via . Learn how to handle taxes on your sports betting income, whether you use DraftKings, FanDuel, PointsBet, or other platforms. Find out if you need to pay income .Forms 1099-MISC and Forms W-2G are expected to be available online at the end of January 2024. A separate communication will be sent to players receiving tax forms as .Tax FAQs. Why am I being asked to fill out an IRS Form W-9 for DraftKings? (US) How do I update personal information on my tax forms (1099-Misc / W-2G) for DraftKings? (US) .Consent to receive IRS Forms 1099, 1042-S, W-2G and other tax information electronically from DraftKings. Learn the requirements, scope and withdrawal of consent for electronic .

To ensure that DraftKings has the correct information for your tax forms, please visit the DraftKings Tax ID form to confirm or update your details. Note: Fantasy app customers .

This site is protected by reCAPTCHA and the Google and apply. The best place to play daily fantasy sports for cash prizes. Make your first deposit!The information provided on this page doesn’t constitute tax advice and DraftKings advises its customers to consult with a professional when preparing their taxes. Learn more about the IRS's taxable reporting criteria for gambling winnings and IRS Form W-2G used to report income related to gambling.To ensure that DraftKings has the correct information for your tax forms, please visit the DraftKings Tax ID form to confirm or update your details. Note : Fantasy app customers can update their IRS Form W-9 via desktop, laptop, or mobile web.DraftKings Help Center (US) My Account; Tax Information; Tax Information Are my winnings on DraftKings subject to state interception? (US) Additional Ways to Contact Us. Mail: US Office. 222 Berkeley St. Boston, MA 02116. Support Hours. Our team is available 24 hours a day, 7 days a week. . The only place I see where a 1099-MISC is applicable is Small Business/ Self employed which is not what my DRAFTKINGS form is from. Please advise as to where I input this other income that is not considered gambling however it was gambling winningsAgree. Speak with tax professional. I never received 1099 from DK or FD on my earnings (not over $600 individually), but I withdrew over $600 over the course of the year, net earnings from both, and received a 1099 from PayPal.You may contact the DraftKings Customer Support Team to request a Win/Loss Statement that details your account activity for a requested time period. To understand how your Win/Loss Statement can be used during tax preparation, DraftKings suggests that you consult with a tax professional. For more information on gambling income and losses . A 1099-MISC form is a type of IRS Form 1099 that reports certain types of miscellaneous income. At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest. [1 .draftkings 1099DraftKings Sportsbook users can wager on the vast majority of teams, sports and events. However, some state betting regulations prohibit wagering on certain sports or athletic events. New Jersey and New Hampshire, for example, do not allow betting on collegiate sports teams from within their jurisdictions. These prohibited bets will not be shown.

This Electronic Disclosure Consent (the "Consent") applies to the electronic distribution of Internal Revenue Service ("IRS") Forms 1099, 1042-S, W-2G and any other IRS forms we may be required to provide to you in the future (together, the "Information Returns") from DraftKings Inc. or any of its affiliates, parent companies, or subsidiaries (together, the .

DraftKings customers in the United States aren't taxed on their withdrawals. Learn more about what is reported to the IRS: Fantasy Sports. Sportsbook and Casino. DraftKings Marketplace. Prev How do I opt in to electronic-only delivery of tax forms (1099/ W .Question for those that have actually received a 1099 from a sportsbook. QUESTION . Does the 1099 tax form only show the total of the amount of money you've won on bets, or does it show the amount you won MINUS the amount you lost? In other words let's say I bet with Draftkings and the total of all my winning bets was $7000, but I also lost .If you take home a net profit exceeding $600 for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC . C au ti on ar y S tate me n t R e gar d i n g F or w ar d -L ook i n g S tate me n ts T hi s A nnua l R e port on F orm 10-K (t hi s “ A nnua l R e port ” ) c ont a i ns forw a rd-l ooki ng s t a t e m e nt s w i t hi n t he m e a ni ng of t he “ s a fe ha rbor” provi s i ons of Reporting Taxes Withheld. Most sportsbooks and casinos will begin withholding federal taxes from your winnings on payouts of $5,000 or more. Think of it like your weekly paycheck. If any taxes on your winnings have already been withheld, make sure to report that on the 1099 or W2-G. If you never got one, contact your sportsbook or .The 1099 tax forms report your winnings to the taxing authorities and let you know the amount you must report on your tax return taxes. Even if you don’t receive a Form 1099, you must report the gambling income on your federal and state income tax returns. This includes the gambling income under the $600 reporting limit for the Form 1099-Misc. Sam McQuillan. Reporter. States have collected hundreds of millions in gaming taxes since the Supreme Court overturned the federal ban on sports betting a few years ago, and the IRS wants its fair share. As many as 149 million taxpayers could be on the hook for taxes on legal winnings this tax season, 23 million more than last year.

If you or someone you know has a gambling problem and wants help, call 1-800-GAMBLER. You must be 18+ to play (19+ in AL & NE and 21+ in AZ, IA, LA & MA). Account sharing is prohibited. This site is protected by reCAPTCHA and the Google and apply. The best place to play daily fantasy sports for cash prizes. Make your first deposit!1099-MISC from draftkings? I’m pretty sure I won over 600 last year on draftkings. I haven’t received a 1099 yet and based on filing deadlines I believe I was supposed to by the end of janurary. . Cannot speak to 1099 requirements for Sportsbooks. You cannot offset your DFS losses with Sportsbooks wins, and cannot offset Sportsbook losses .

draftkings 1099|How do I opt in to electronic

PH0 · Where can I find my DraftKings tax forms / documents (1099/ W

PH1 · Where can I find my DraftKings tax forms / documents (1099/ W

PH2 · What are the 1099

PH3 · Tax FAQs – DraftKings Help Center (US)

PH4 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH5 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH6 · Key tax dates for DraftKings

PH7 · How do I update personal information on my tax forms (1099

PH8 · How do I opt in to electronic

PH9 · DraftKings Tax Form 1099

PH10 · DraftKings